What are closing costs?

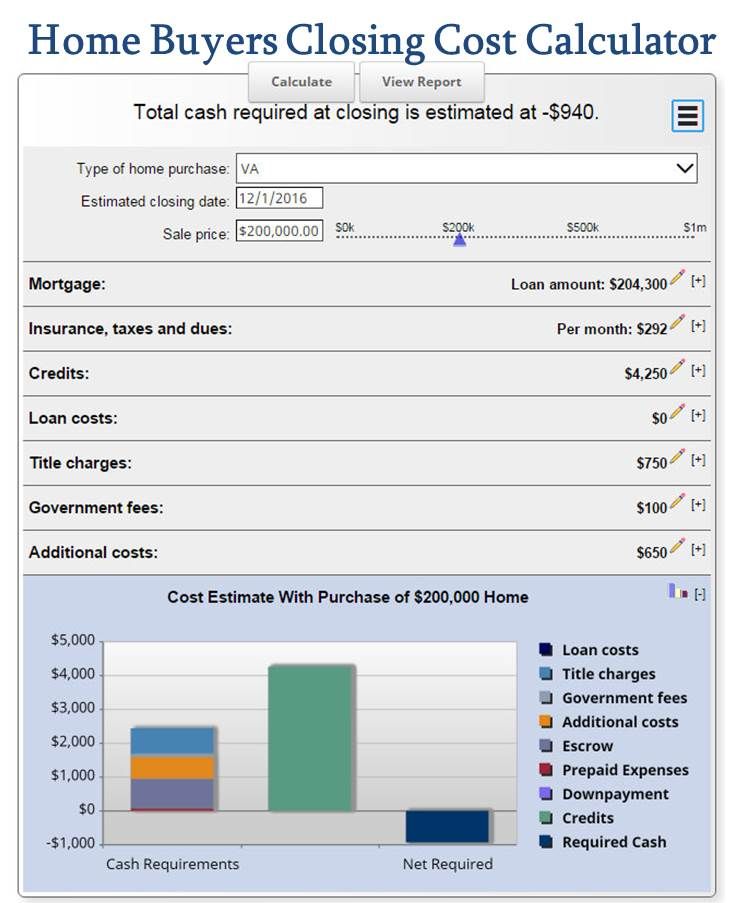

Closing fees are extra charges that you pay to complete the home-buying process. Included in these costs are taxes and fees associated with real estate transactions. Both the buyer, and the seller are responsible for paying them.

These closing costs consist of both one-time fees as well as the initial installments you will pay each month along with your mortgage. These costs can include homeowners' insurance and property taxes, and they vary from lender-to-lender.

Some of these upfront fees are fixed and some are based off the loan amount. You'll probably have to pay an attorney fee and courier costs.

Closing costs typical for buyers

Closing costs are usually six percent of a buyer's purchase price, and they vary according to the local and state property tax rates. These fees can include the title company fee, escrow charge, appraisal fee and record filing.

What are the typical closing costs of refinances?

Closing costs for a refinance are typically lower than those for a purchase. But they still must be taken into account. The Loan Estimate that lenders send to buyers three days after applying for a loan will include estimated closing costs.

This estimate must not only be accurate but also easy to comprehend. This is why it's so important to read the documents very carefully, asking questions whenever you don't fully understand something.

What are closing costs for home sellers?

Home sellers usually have to pay various closing costs including brokerage commissions and tax on property transfers. Many home sellers also have to cover prepaid interest for their mortgages, along with fees for pest inspections and home inspections.

If the service provider is willing to lower their fee, they can negotiate this cost. The seller can offer a credit to the buyer, which covers a part of their closing costs.

How can you avoid closing costs?

It is best to find the right mortgage to avoid any closing costs. Before applying for a loan, it's crucial to take into account your credit score and debt-to income ratio.

Getting preapproved for a mortgage will help you understand how much your closing costs will be, and it will give you time to research prices in your desired neighborhood and city. You'll also be able to compare different lenders and their fees before making a final decision.

Sellers must also pay the mortgage recording tax for the seller and the title transfer fee. Both fees usually equal 1.825% or more of the selling price. Buyers often overlook these fees, which can add up to 2% on the price of a home.

FAQ

How can I eliminate termites & other insects?

Your home will eventually be destroyed by termites or other pests. They can cause serious destruction to wooden structures like decks and furniture. This can be prevented by having a professional pest controller inspect your home.

Should I use an mortgage broker?

Consider a mortgage broker if you want to get a better rate. Brokers are able to work with multiple lenders and help you negotiate the best rate. Brokers may receive commissions from lenders. Before signing up, you should verify all fees associated with the broker.

How do I calculate my interest rate?

Market conditions can affect how interest rates change each day. The average interest rate for the past week was 4.39%. Divide the length of your loan by the interest rates to calculate your interest rate. If you finance $200,000 for 20 years at 5% annually, your interest rate would be 0.05 x 20 1.1%. This equals ten basis point.

How can I determine if my home is worth it?

If your asking price is too low, it may be because you aren't pricing your home correctly. Your asking price should be well below the market value to ensure that there is enough interest in your property. Our free Home Value Report will provide you with information about current market conditions.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

External Links

How To

How to Find an Apartment

Moving to a new place is only the beginning. Planning and research are necessary for this process. This includes researching the neighborhood, reviewing reviews, and making phone call. There are many ways to do this, but some are easier than others. Before renting an apartment, it is important to consider the following.

-

You can gather data offline as well as online to research your neighborhood. Websites such as Yelp. Zillow. Trulia.com and Realtor.com are some examples of online resources. Offline sources include local newspapers, real estate agents, landlords, friends, neighbors, and social media.

-

See reviews about the place you are interested in moving to. Yelp. TripAdvisor. Amazon.com all have detailed reviews on houses and apartments. You may also read local newspaper articles and check out your local library.

-

Make phone calls to get additional information about the area and talk to people who have lived there. Ask them about their experiences with the area. Ask for their recommendations for places to live.

-

Consider the rent prices in the areas you're interested in. Consider renting somewhere that is less expensive if food is your main concern. However, if you intend to spend a lot of money on entertainment then it might be worth considering living in a more costly location.

-

Find out more information about the apartment building you want to live in. Is it large? What's the price? Is it pet-friendly? What amenities are there? Can you park near it or do you need to have parking? Do tenants have to follow any rules?