An offer letter must be prepared before you make a formal offer on a house. Here are some tips on how to write a strong offer letter:

Write a personal note to the seller

To get the seller's attention when you write a letter, make sure to include your personal contact information. These are the most important features that homeowners love. Include them in your letter along with the reason you're interested. Your family and other personal information should be avoided as this could be taken to mean you are discriminating. Instead, be positive about the house and its amenities.

When writing a personal letter to the seller, try to sound sincere and friendly, but make sure you're not too formal. Do not sound fake. Instead, focus on the reasons you are buying the house. You should also remember that if the buyer is part of a protected community, a less personal letter might be more effective. If the seller is a member of a protected class, you can include drawings or pictures of the family. You have the opportunity to make a positive impression on the seller, and to get the deal done.

Your needs should be put above the needs of the seller

When writing an offer, always remember that the seller's needs and wants should come first. Even though you might be the buyer in this situation, your needs will not be ignored. If you are the only buyer on a seller market, it is possible that you have a unique set of needs. So be open to compromise. A contingency provision will give you a legal right to withdraw your offer if it is rejected by the seller.

Avoiding common deal-breakers

The most important thing to do when you make an offer for a house is to stick with the price range. The house you want to buy should be comparable to the houses around it. It should be comparable in quality and cost. While you cannot make certain things right, you can improve or repair the house to make it more appealing. Do not forget to tell buyers about any minor issues.

Some buyers find it hard to live with noisy neighbours or children. While this may be a problem for some, it's worth considering whether you'd like to live with a noisy neighbour. Make sure your house is located in a safe neighborhood for children. Although not all buyers have children, most buyers will have at least one.

In the offer, include a date of expiration

Filling in the blanks on an offer to buy a house can make it easier for you to provide useful information. When including an expiration date in an offer, you will avoid the risk of a seller moving on or dropping your offer because you haven't responded right away. If you offer to buy a house in a week, for example, the seller will have enough time to look at the offer before making any decision.

The buyer must sign the contract before extending an offer. If the seller has not accepted the contract by that time, the buyer can make another offer. This will be a counteroffer. But a rational buyer won't run if the seller rejects the offer before the expiration date. The buyer will continue to negotiate with the seller, showing his patience. A smart move in real property is to include an expiration deadline in your offer.

FAQ

Is it better for me to rent or buy?

Renting is typically cheaper than buying your home. However, you should understand that rent is more affordable than buying a house. Buying a home has its advantages too. For instance, you will have more control over your living situation.

Are flood insurance necessary?

Flood Insurance covers flood damage. Flood insurance helps protect your belongings and your mortgage payments. Learn more about flood coverage here.

How can I get rid Termites & Other Pests?

Over time, termites and other pests can take over your home. They can cause damage to wooden structures such as furniture and decks. To prevent this from happening, make sure to hire a professional pest control company to inspect your home regularly.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

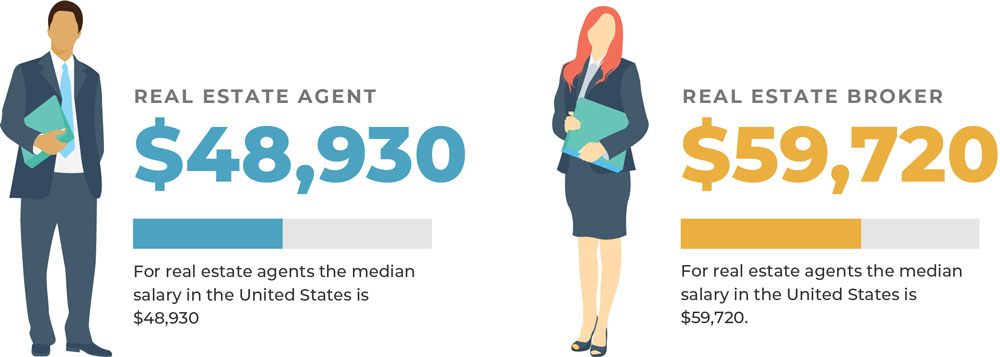

How to be a real-estate broker

An introductory course is the first step towards becoming a professional real estate agent. This will teach you everything you need to know about the industry.

The next step is to pass a qualifying examination that tests your knowledge. This requires you to study for at least two hours per day for a period of three months.

This is the last step before you can take your final exam. You must score at least 80% in order to qualify as a real estate agent.

These exams are passed and you can now work as an agent in real estate.