To obtain a Texas license in real estate, the first step is to complete a pre-licensing class. This intensive series includes classes that cover all aspects of realty, including contracts and mortgage documents. This course will also cover specialized financing options.

Once you have completed all pre-licensing classes, it is now time to sit for your licensing exam. You can take the test in person or on the computer, and it's administered by TREC. After passing, you'll get a Texas real estate license. The fee for this is small. The cost of the license depends on the applicant's budget.

You will need to study and prepare for the exam for at least a few weeks in order to pass it. There are a number of study guides available for sale, including the ACEable Pre-License package, which includes study guides and an actual pre-licensing test.

Texas realty licenses are required to practice as an agent. It is not necessary for real-estate brokers. Rather, brokers can choose to work for themselves, or they can hire other agents to help them with their business.

The average time it takes to obtain a Texas real-estate license is six months depending on where you go and how fast your studies are going. If you want to make the most of your time, you may want to consider enrolling in a real estate training program. This can seem like a difficult task but it is worth the effort.

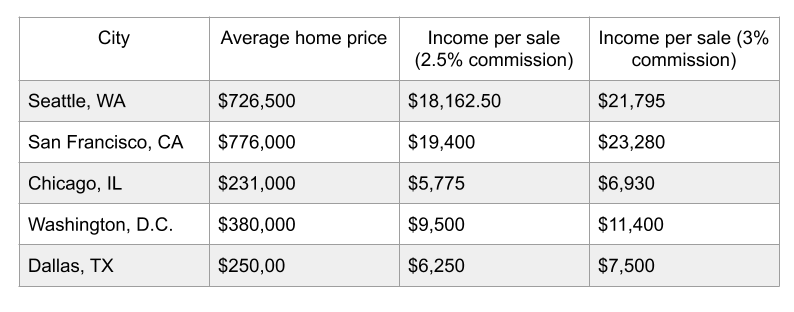

Before you sign up for a real estate class, be sure to find out whether the institution is accredited. It is also important to have the financial ability to pay tuition. These can vary from $400 to more than $1000. You should also check out local markets and ordinances. Your earning potential as a real estate agent could be affected by the property values in certain neighborhoods or communities.

Real estate is a competitive industry, so you will need to be a great salesperson to succeed. You will need to continue your education by taking a few courses. You will need to be familiar with local building materials and systems if you intend on specialising in a certain type of home.

Getting a license in Texas isn't as difficult as you might think. To get a Texas license, you'll need pass several tests including the TREC licensure exam. Those exams are taken through Pearson VUE, and it will typically take about a week to process.

It is also important to know if you are a United States citizen. Your chances of getting a license are higher if you have at least 18 years old identification. Of course, you should also be aware that if you've had a criminal offense, you may not qualify for a real estate license.

FAQ

How do I know if my house is worth selling?

Your home may not be priced correctly if your asking price is too low. A home that is priced well below its market value may not attract enough buyers. Get our free Home Value Report and learn more about the market.

What should I look for when choosing a mortgage broker

A mortgage broker helps people who don't qualify for traditional mortgages. They shop around for the best deal and compare rates from various lenders. Some brokers charge a fee for this service. Some brokers offer services for free.

What are the drawbacks of a fixed rate mortgage?

Fixed-rate loans have higher initial fees than adjustable-rate ones. Additionally, if you decide not to sell your home by the end of the term you could lose a substantial amount due to the difference between your sale price and the outstanding balance.

What is a "reverse mortgage"?

Reverse mortgages allow you to borrow money without having to place any equity in your property. This reverse mortgage allows you to take out funds from your home's equity and still live there. There are two types of reverse mortgages: the government-insured FHA and the conventional. You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. FHA insurance covers the repayment.

How many times can I refinance my mortgage?

This will depend on whether you are refinancing through another lender or a mortgage broker. In both cases, you can usually refinance every five years.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to Find Real Estate Agents

Agents play an important role in the real-estate market. They sell homes and properties, provide property management services, and offer legal advice. The best real estate agent will have experience in the field, knowledge of your area, and good communication skills. You can look online for reviews and ask your friends and family to recommend qualified professionals. Local realtors may also be an option.

Realtors work with buyers and sellers of residential properties. A realtor's job it to help clients purchase or sell their homes. Apart from helping clients find the perfect house to call their own, realtors help manage inspections, negotiate contracts and coordinate closing costs. Most agents charge a commission fee based upon the sale price. Some realtors do not charge fees if the transaction is closed.

The National Association of REALTORS(r) (NAR) offers several different types of realtors. Licensed realtors must pass a test and pay fees to become members of NAR. To become certified, realtors must complete a course and pass an examination. Accredited realtors are professionals who meet certain standards set by NAR.